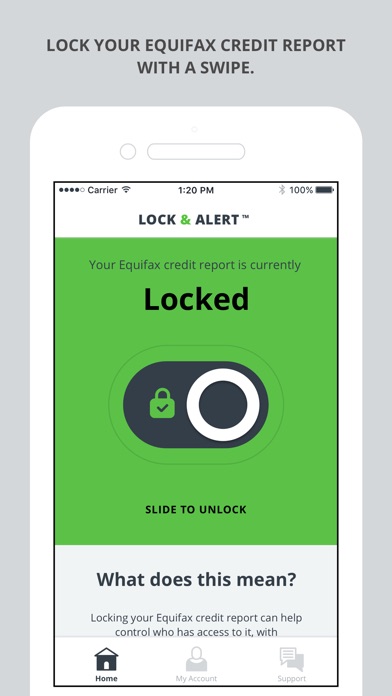

Lock & Alert app for iPhone and iPad

Lock & Alert puts you in charge of who can access your Equifax credit report, with certain exceptions.¹ Lock or unlock your Equifax credit report with just a simple click or swipe, and we’ll alert you each time your Equifax credit report is locked or unlocked.

Lock & Alert is free for U.S. consumers.

Lock your Equifax credit report to help better protect against identity theft.

Applying for credit? Open the app, and unlock with one simple swipe or click. Then simply swipe or click again to lock when youre done.

Well alert you each time your Equifax credit report is locked or unlocked.

Having trouble or need a quick answer while using the app? Visit the Support tab in the app to find the answers to frequently asked questions, or to contact customer service.

Sign in to the Lock & Alert app using Touch ID, Face ID, or enter your user name and password.

Note: Lock & Alert and myEquifax use separate accounts. Your Lock & Alert credentials would be different from your myEquifax username and password, unless you registered with the same username and password for both. If this is your first time using Lock & Alert, please choose “Sign up”.

¹ Locking your Equifax credit report will prevent access to it by certain third parties. Locking your Equifax credit report will not prevent access to your credit report at any other credit reporting agency. Entities that may still have access to your Equifax credit report include: companies like Equifax Consumer Services LLC, which provide you with access to your credit report or credit score, or monitor your credit report as part of a subscription or similar service; companies that provide you with a copy of your credit report or credit score, upon your request; federal, state and local government agencies and courts in certain circumstances; companies using the information in connection with the underwriting of insurance, or for employment, tenant or background screening purposes; companies that have a current account or relationship with you, and collection agencies acting on behalf of those whom you owe; companies that authenticate a consumers identity for purposes other than granting credit, or for investigating or preventing actual or potential fraud; and companies that wish to make pre-approved offers of credit or insurance to you. To opt out of such pre-approved offers, visit www.optoutprescreen.com.